When her Majesty the Queen launches a ship, she smashes a bottle of Champagne against the bow and the world's media gather to hear her speech.

We do things a little more discreetly here at Akoni!

This week – after months of hard work behind the scenes – we are proudly launching our exciting new platform to help SMEs manage their cash.

We are starting with what the marketers call a 'soft launch'. There's no big public fuss or palaver, and we haven't invited any royals along. Although, admittedly, we might toast the event with a cheeky glass of fizz!

But why is there a need for Akoni in the first place?

Because, even in this low interest rate environment, UK SMEs collectively miss out around £3bn per year on interest on the £258bn they have in cash balances. We think that's wrong, and decided to do something about it!

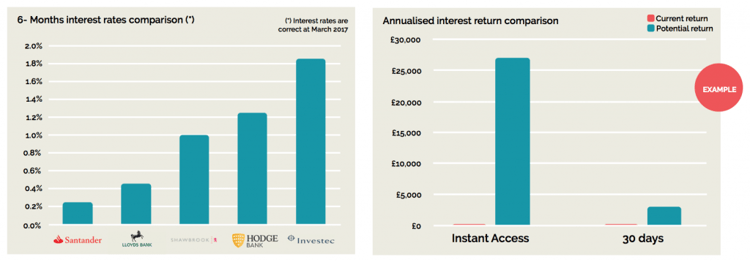

There are banks that offer interest rates up to 2.2% compared to high street 0%. However, most companies are not aware of the better rates that are out there, due to lack of product transparency. What's more, they are put off by the perceived cost of switching.

How Akoni benefits SMEs

It takes time to shop around for the best business bank account, and then transfer your cash deposits to the product where they will achieve the best interest rate.

This is where Akoni comes in.

At AkoniHub, SMEs can download their personalised cash report and search latest rates at a glance. Then, using our simple Deposit Planner, they can unlock the potential of their cash and maximise the returns they receive.

Here's an example

The average business improves their return by 10-12 x current income. For example, an SME has £2 million cash held in an instant access account. By transferring the money to banks with higher rates, the company would generate an additional £30,000 per year, even maintaining the same deposit maturity period.

That return could buy more than a few bottles of Champagne! More feasibly, it could provide for a new marketing campaign or a staff member, contributing to the SME's productivity and profit and boosting the UK economy.

Felicia Meyerowitz Singh, CEO and co-founder of Akoni said: "SMEs are the engine of the UK economy. By saving them time and helping them make more money, Akoni will make a real impact."

And there's more!

A survey by Soldo states that UK SMEs collectively lose more than $10.2 billion every year, because they aren’t managing their cashflow properly.

The research found that SMEs average over four hours per week on managing company finances such as invoices, employee expenses and financial forecasting. The scale of the task grows with the size of the business, but even 15% of startups said they found daily cash management to be a particularly difficult challenge.

Soldo Founder and CEO, Carlo Gualandri, said: “If staff were freed up to dedicate their time to the activities that made a big difference to the company, productivity levels would rocket.”

Technology is the answer.

In order to save time and money, technology is helping to automate many business systems and processes, and cash management is no exception.

We've harnessed technology to build a range of simple and efficient tools that are now available for SMEs to use straightaway:

See Akoni's tools at a glance

- Deposit Marketplace

Check today’s best rates at a glance, and filter them according to the governance requirements of your business. - Cash Management

Your personalised Cash Management Report shows how much interest you gain by utilising Akoni’s tools, and provides tips and guidance for optimal cash flow management. - Deposit Dashboard

Build your cash deposit portfolio by trying different alternatives until you find what works for your business. - Income and Expenditure Planner

Enter your key cash inflows and outflows to create an efficient portfolio that maximises returns, while ensuring future expenses are covered. - Financial Bootcamp Report

Get sector-based data that will help you identify opportunities and areas for cash management improvements.

Felicia said: "Akoni solves a problem that most SMEs don't even know they have, and enables them to access corporate-level returns on their cash."

Signup for free at AkoniHub.com

Coming soon...

But we're not stopping there!

Akoni members will soon be able to access a range of additional cash management services on the platform, such as an Automated Cash Allocation algorithm and advanced Cash Projection tools. It's all part of the Akoni mission to help UK SMEs to make the most of their cash.

We think her Majesty would be proud.

Akoni helps businesses make the most of their cash. Register for free at AkoniHub.com

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save