1. Background:

Cash, albeit safe, is always linked to “inflation risk” or the rising prices which can erode your savings. It is of course true but in a very volatile economy with slow growth and rising macroeconomic risks, cash is earning its position as a true asset class. In fact, in 2018, a 12-month average Sterling deposit rate at 1,20%, would have been the best performing of all asset classes. Better than any index trades, money market funds, gilts and even the mighty asset managers and in particular Hedge Funds with their high fees. The latter being particularly exposed to specific systematic quantitative strategies (FT article 3rd of January 2019). Overall, Hedge Funds saw their biggest annual loss since 2011, declining 4,1% on a fund-weighted basis (Hedge Fund research Inc).

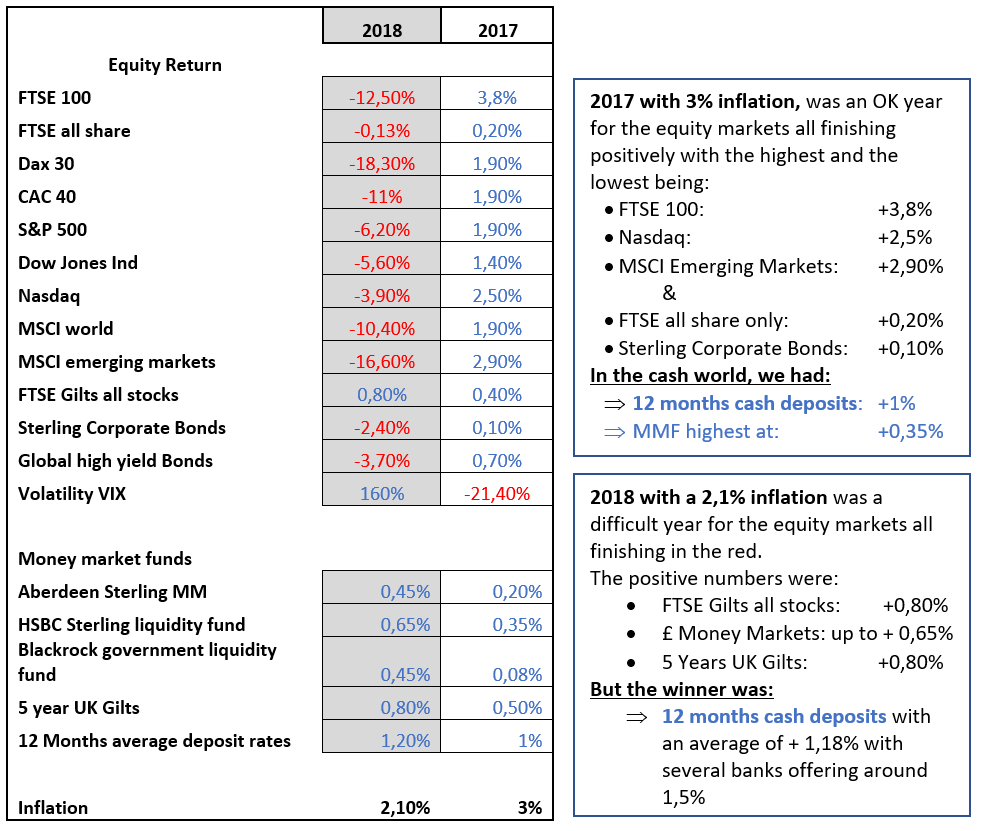

2. Historical yield, data & some analysis

3. Asset class analysis

- 2018 was a bad year for all asset classes, despite reduced inflation, except for cash via bank deposits and to a lesser extent money market funds both achieving decent positive returns all be it not enough to cancel the inflation impact. Equity markets performed relatively well until the last couple of months, as it collapsed due to tightening monetary policies, reduction of quantitative easing (QE) and trade wars. Volatility, potentially good for aggressive traders increased by a massive 160% during 2018.

- 2017 was by and large a better year but with much higher inflation levels. Nevertheless, cash as an asset class did perform well and easily beat the FTSE all shares index, corporate sterling markets, and the UK gilt market by quiet a long way.

4. Cash as an asset class

Historically, cash is affected by inflation but with lowering inflation and rising interest rates, cash is becoming a true asset class for any strategies and it is a good way to manage your risk. In fact, according to the Investment Association the UK equity markets saw negative net flows of £41.3Bn in 2018 leading financial advisers to review their asset class distribution going forward.

- For wealth managers, it is a must to either take advantage of market opportunities or ride out of difficult markets and reach long term strategies.

- While for a SMEs it is the safest route to generate safe returns (best in 2018 and still strong in 2017) and making sure that cash is available when and if required.

5. Going forward

2019 and 2020 are expected to be challenging years with, among others, slow global growth and rising risks that will weight equities (Stock evaluations are high) and portfolio strategies.

- Equity is very sensitive to central banks rate policies, which in turn are driven, among others, by inflation and growth.

- UK will be impacted by the confusion surrounding Brexit leading to high volatility levels and making cash a safe investment compared to UK indexes or gilts.

- US could even enter recessions in 2019 or more likely in 2020 (it is tomorrow) because of slow down in the world & US economies, fuelled by trade wars and Central banks reduction in their QE strategies which will have an impact on rates.

The wealth management industry is waking up to the importance of cash as a competitive “asset class” as equities are expecting to deliver poor results and bonds are unlikely to be much better.

Cash might be boring but according to JP Morgan AM, “Cash now offers a better risk adjusted return than equities” and investors & wealth managers should raise their cash allocations for a better diversified portfolio as part of a defensive strategy including “Black Swan” (A surprising or disruptive event).

Goldman Sachs outlook for 2019, recommends investors to start getting defensive and raise their cash allocations.

Schroders Global Investor study (December 2018) shows that the US investors have about 20% of its portfolio in cash, which will have achieved the best return in 2018.

6. Conclusion

Cash cannot be ignored as a real “asset class”, but one of the most common issues for SMEs cash balances and wealth management firms (both the management & strategy cash), is to identify and act easily on the best deposit rates offered by the markets (Akoni solution). In fact, in the FCA paper (strategic review of retail banking (December 2018), reflects a propensity for customers not to shop around to get a better deal and achieve a better return. This does not make sense with technology development, PSD2 / Open Banking and FinTech innovation, which should and will provide better opportunities for SMEs & wealth managers to achieve better returns on their cash.