Facebook's SheMeansBusiness is a global campaign that has been running for almost five consecutive years, this initiative created a space for entrepreneurial women to make valuable connections, share advice and move forward, together.

Backed by Enterprise Nation and NatWest, event gave us the opportunity to present at the four hour session. The event featured thought leaders, such as, NatWest CEO Alison Rose and Not On The High Street’s Holly Tucker, plus other innovators within the fintech/wealthtech space.

I was able to cover four key topics, all vital information for early stage entrepreneurs and C-level executives managing cash.

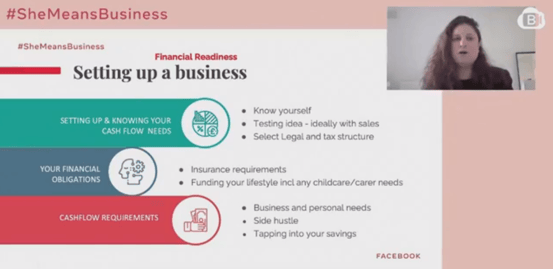

Throughout the #SheMeansBusiness presentation, I highlighted four main points to consider when building a successful business.

1. Knowing yourself, your business and your cash needs

Building a business can be expensive. It is an investment that needs to be thoroughly thought-out as it impacts both the company's future success and your personal finances also.

If you’re starting out, you need to be brutally honest and ask yourself a few questions, such as:

- Are you the type of person who can give up personal holidays for one or even two years to save cash?

- Do you have enough cash reserves in case of a personal emergency?

- Do you have enough money to continue, and/or to cover childcare costs?

- How can you test your idea and in the process make a few sales? This will help you validate your idea on the market and see if people will spend money on your product or service. It can also help generate some cash to reinvest in the business.

- Are you prepared to have a side hustle, or make the business your side hustle whilst working a full-time job?

- Are you prepared to dip into your savings to cover your business if you need to?

- Will you stop adding cash to your pension, or will you still be able to contribute? If you do stop contributing, are you aware of the financial implications?

2. What are your personal financial obligations?

By answering the above questions, and the many more that will crop up, you will be able to understand how you will fund your lifestyle whilst starting your business.

There are certain financial obligations that women have to deal with on a larger scale in comparison to their male counterparts, such as being the primary carer relatives, including childcare. Either way, you need to know what the fixed costs are for you personally before setting out on your endeavours. Only by understanding this, will you be able to set yourself up for financial success.

What are the cash flow requirements of the business?

It is essential that you map out your future business cash flow requirements. You should accept early on, that you will not be making a lot of revenue immediately.

Your costs will far outweigh your revenue at the start, which is why it is key to map out both fixed and variable costs for your business to help you better understand what you need to spend money on, and where you can save money.

An important point to consider - ensure that you know the right taxation structure necessary for your business. If you register as a sole trader or as an LTD company, both have different costs, legal burdens, insurance requirements and tax implications attached. You need to ask yourself what structure works best for you personally, and for your business.

One route to help you better understand this is by hiring an accountant. Although saving cash is key, there will be instances where it is worth spending money to develop your business and this may take up a lot of your time. Remember, time is a valuable asset and it should be seen as an additional cost to the business.

So how do you manage your cash flow?

This is the difficult part. At its core, cash management gives you an up-to-date picture of your business and helps you make strong, financial decisions that support the health of your company.

Once you have figured out your personal financial requirements, the structure of your business, the risks and liabilities and what the cash requirements are, the next stage of managing your cash flow will entail frequent involvement from a trusted financial partner (accountant, CFO, financial advisor etc).

Going forward, things to consider and by no means is this list exhaustive will be:

- Every week, check in on where you are as a business financially.

- Keep track of where the money is coming and going

- Consider every single detail - how much is stationary costing you? These little costs add up and should not be discounted as pennies to you or your business

- Anticipate when the money is coming from your clients. What invoices need to be paid to you and which suppliers do you need to pay? If you do not get paid on time, what does that mean for company cash flow?

- Consider how you are billing clients. If you need the money in five days, don’t be afraid to ask them to pay you within the five days. Consider upfront options such as a credit or debit card payment.

- Think about the power of interest. If you have idle cash sitting, maybe for a future VAT or tax payment, it might be worth putting it in an interest-accruing account. Compounded interest is almost magical, the more you start setting money aside, the more you save, the more you earn interest. In tandem, you should pay attention to your financial status. Unfortunately, it still holds true that there is a gap where women lose time on their earning power, and in turn, their potential to save more and earn compounding interest.

- What grants, free money or awards can you get for your business? There are many women-focused cash incentives out there. You should consider every single avenue to receive cash and pump it into your business.

- Use tools that save you time and money, such as those who use Open Banking APIs - there are a range of cash management tools, like Akoni, that uses nudges to educate and empower better financial control.

Once you have gone through these scenarios, you will be prepared financially, which in turn will ultimately save you time and money.

For many entrepreneurs, financial worries are their top concern. It is important to note that financial health is linked to mental health too, something you should keep in check especially when running a business.

Cash is the lifeblood of any business - it pumps energy into your business and helps you to continue to survive and thrive. If you are in a better financial state, your mental health will reap the benefits in the short and long term allowing you to put your energy into building and growing a business.

You can see more over at the #SheMeansBusiness Sessions (and my piece starting from 2:13:57) here.

About Akoni: Akoni is an award-winning UK cash platform, which provides a marketplace to SMEs and charities, as well as to individuals through our white label distribution partners including IFAs, wealth platforms, accountants and SME hubs. Akoni uses innovative technology to personalise cash planning solutions for clients, and also provides a full API solution to banks and insurance clients.

Contact us contact@akonihub.com and Find out more www.akonihub.com