We love watching trends in the savings space, it gives us a lot of validation that the wealth market is moving constantly, and that no matter the circumstances the industry can emerge stronger.

We have now lived through the biggest slump on record (between April to June 2020), where the economy shrank 20.4% compared with the first three months of the year. This pushed the UK into its first technical recession - defined as two consecutive quarters of economic decline - since 2009.

Since the pandemic started in mid-March 2020, we have seen many articles outlining the current state of the economy. Although some predictions were made pre-covid of a future recession (for many different reasons), the majority of people were just as shocked as each other to see that the economy had suffered so greatly at the hands of a virus.

During times of distress, and living through an unexpected, huge economic decline in such a short period, we all saw people’s, and our own behaviour change, especially when dealing with our earnings.

As the Financial Times states: “Savings rates often rise during recessions. The desire to hoard cash is a barometer of fear, as the economist John Maynard Keynes wrote in 1937. This gave rise to his paradox of thrift: savings might be good for the individual but if everyone tries to save at once the result is a fall in economic activity; one person’s spending is another’s income. When an entire society tries to cut back, incomes collapse and the savings fall far short of expectations”.

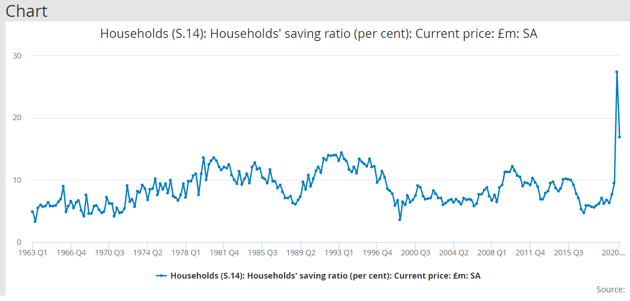

The graph below shows the household savings trend spike during the pandemic:

*Source: The Office for National Statistics

Those living in the UK experienced or watched friends, family and acquaintances get placed on government schemes such as furlough, lose their job, or close up their business temporarily and permanently due to lockdowns.

Income security, the lack of activities to spend on, and the uncertainty and fear placed onto people’s lives so drastically changed everyone’s thinking around cash, and the statistics support this.

Various lockdowns in Canada, France, the US, the UK and Germany caused families to not spend at least a fifth of their earnings according to the Organisation for Economic Co-operation and Development (OECD).

As household savings rose to an all-time high of 29.1% last year, and the number of people stashing their cash away for the first time in years rising significantly, these new savers started to make headlines and began a much more mainstream conversation about wealth and savings. Spending fell by 23.6% as people started to save money from not spending on what was considered a necessity pre-March 2020 - this includes travel and food costs, and luxury items like holidays and nights out.

According to another study, 85% of UK adults have spent less during the lockdown. On average, people saved, per month, £49 a month on petrol, £57 by not going to pubs or restaurants, £53 by not going to shops, and made significant savings in other areas, totalling £617 a month on average for those still receiving their full income. The report also found that 31% of people with savings accounts had increased their monthly deposits since the start of lockdown. Furthermore, last year, the Savings Ratio (the percentage of disposable income that is saved in a household, and a general indicator of economic activity) hit 17%, up from 8.4% the previous year.

However, as to be expected, with each person who saved money, another person may not have had the same experience with money throughout the pandemic. According to the UK Government: “As a whole, household savings have risen and debt has decreased. There is evidence to suggest that some households, particularly those with low incomes, have run down savings and increased debt since the start of the pandemic”.

Savers have begun to feel concerned around their new savings as their accounts offer little to no way of interest on top of their savings, with some worried they will be penalised for keeping cash stored away in their accounts. The Bank of England has been toying with the idea of putting its base rate to 0%, to encourage lending from banks and consumer spending.

In the past week, the Bank of England’s main lending rate has been held at 0.1% as the Bank of England’s Monetary Policy Committee (MPC) voted unanimously nine to zero to keep the base rate as it currently is. There have been many discussions and a lot of back and forth on negative rates and what that means for savers for many months now (we spoke about this on a blog earlier this year).

This increase in savings across the UK has prompted hope amongst economists that there will be a spending rebound after the lockdown. To increase cash flow within the economy, there have been a few initiatives put into place.

To boost spending, UK Chancellor of the Exchequer, Rishi Sunak implemented government schemes such as ‘Eat Out to Help Out’ to encourage people to leave their home, and spend within the hospitality industry - arguably one of the hardest-hit industries from the pandemic. Furthermore, the stamp duty holiday was extended to encourage people to buy property. More schemes like this are expected to follow once the current lockdown (from mid-December until mid-April) ends.

Although we will all be happy to see the back of these lockdowns as we inevitably learn to live with the virus, we have started to see light at the end of this tunnel and reflect on the positives as well as the huge negatives of the last year. We see three huge positives for savers and the wealth industry as household savings increase: 1) A lot more people have had the chance to save, pay off debt, create a financial safety net for themselves, investing and getting themselves on the property ladder; 2) The wealth management industry has evolved much more quickly technologically, and 3) IFAs and wealth managers can now work with a wider audience of people from all backgrounds and ages who care about intergenerational wealth for the future.

So, why should you choose Akoni to help you with your client’s cash decisions?

1) Safe and secure with FSCS protection

All deposits are held with each bank providing protection of up to £85,000 per bank, or up to £1 million for Temporary High balances.

2) Diversifying risk (spreading money across savings providers)

With the option to spread cash across several providers on the Akoni Cash Management Platform, you can diversify risk, and increase the chances of positive returns.

2) Increased returns & Better interest rates

In a climate of economic uncertainty, and with interest rates being cut across many providers, it’s not easy to find decent interest rates in a simple way. With Akoni, you can find competitive interest rates to suit your client’s specific needs.

4) Quicker, and hassle-free - no form filling

Akoni Hub provides a hassle-free cash management experience - your clients can onboard and open an account online with no fuss. Clients will only need to complete one AML/KYC process, can switch between providers, and manage their account on the Akoni Cash Management Platform in just a few clicks.

5) White label Adviser portal and tools

You have the flexibility to create a platform that works for you and your clients. Add your branding to showcase who you are through a sleek, professional cash management platform designed with you in mind.

Find out more about Akoni: Akoni is an award-winning UK cash platform, which provides a marketplace to financial advisors and wealth managers through a bespoke white-label offering, or off-the-shelf offering. Akoni uses innovative technology to personalise cash planning solutions for clients, and also provides a full API solution to banks and insurance clients.