The UK has so far defied the pessimists over Brexit, and done remarkably well in its recovery from the latest recession.

The fast-growing FinTech sector is doing particularly well, and the government has identified it as a priority area, saying it provides 60,000 jobs and contributes around $9 billion to the economy.

According to trade body, Innovate Finance, $564 million of venture capital poured into British FinTech companies in the first half of 2017. That's up 37% from the first half of 2016.

More than half the investment came from outside Britain, with a third coming from venture capital firms based in the United States.

Worldwide, FinTech investment for the first half of the year stood at $6.5 billion. Just over half that went into US startups and $1 billion into China. That places the UK third for global FinTech investment.

The UK figure still lags behind 2015, when a record $676 million was invested in the first half of the year and over $1.3 billion for the entire year. However, from July 1 to July 23, UK FinTech has already raised another $155 million.

Abdul Haseeb Basit, Innovate Finance's Chief Financial Officer, told Reuters: "Things have slowed but we've seen an improving recovery since the referendum last year."

But it's not all good news.

- Unemployment has fallen to a 40-year low (however, inflation-adjusted wages are significantly below the level they were ten years ago)

- The UK has been the second fastest growing economy in the G7 for the past two years (however, growth is based on household and government consumption, not investment and net trade)

- Business investment as a share of GDP is virtually back to pre-crisis levels (however, it is still low by international standards and seems to have plateaued. In manufacturing, it fell by 6.6% last year)

- Profit margins in the first quarter of 2017 rose to a post-recession high (however, companies are choosing to save, rather than invest)

- Sterling has lost value since the Brexit vote (however, instead of improving their export prices or investing for productivity, UK firms are banking the extra profit in low-interest or no-interest deposit accounts)

Productivity is the 'magic pill' that raises economic output per worker and leads to higher wages and living standards – but productivity growth is lower.

One of the reasons for the UK’s weak productivity, is poor levels of investment.

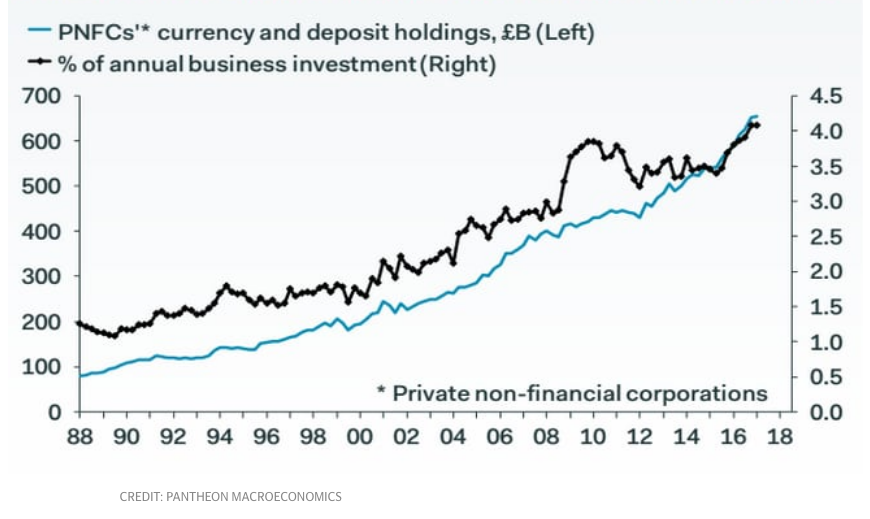

Cash deposits by private non-financial corporations were up by more than 10% last year, reaching 648bn. That's equal to four times annual business investment and nearly a third of annual GDP.

Samuel Tombs, chief economist at Pantheon Macroeconomics, says business investment would surge if firms spent just a small proportion of their stockpiled cash.

With uncertainty hanging over the UK economy, it seems that companies are looking to invest more abroad, particularly in the eurozone, and less at home.

Chancellor Phillip Hammond, has reportedly said that we must hold our nerve and stick to the plan for bringing the public finances back into balance.

SMEs are the bedrock of growth, and underpin our economy. We therefore support the calls for the Chancellor to make Britain the best place in Europe to invest, by offering tax incentives and any other measures.

Meanwhile, businesses should be using cash planning tools to generate income from their surplus cash. By moving it into accounts with the best interest rates, they could earn enough to employ a new staff member for improved productivity, or to launch a marketing campaign that drives further business growth.

Akoni helps businesses make the most of their cash. Register for free at AkoniHub.com

Save

Save

Save

Save

Save

Save

Save

Save

Save