A black swan according to Mr. N N Taleb author of the Black Swan theory is based on 3 factors: “- It is an outlier (deviation unpredictable) - it carries an extreme impact and - it seems obvious after the fact “

- As terrible as it can be, the Coronavirus is not an outlier. In fact, the Head of the World Health Organization (WHO) already predicted in 2018 that a devastating epidemic could kill millions of people because we are not prepared. The H1N1 in 2004 and the Ebola virus in 2015[1] were clear indicators that a new epidemic was not unpredictable.

- What about the market? Well it is reacting to the economic impact to various industries and impact of global supply chain. It is further impacted by oil prices and a battle between OPEC and Russia. A story of supply and demand with probably a link with the US oil strategy.

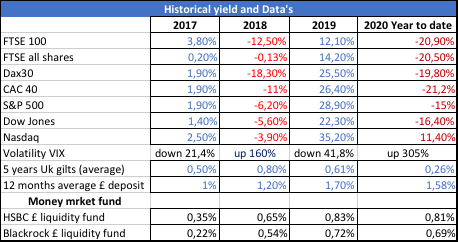

My understanding about Coronavirus is certainly above my pay grade and I would not like to comment on the financial markets with, “we told you so” or “the market was ready for a correction anyway”. However, I would like to come back to the central idea of the Black Swan’s theory. In essence, it is not to attempt to predict Black swan events, as most of the time it is pretty much impossible, but more to build robustness to negative events and the ability to exploit those events. In fact, in early 2019, we wrote a note about Cash as an Asset class and its historical yield and performance. (Updated below)

2020 Year to date: 10/03/2020

2020 Year to date: 10/03/2020

The analysis showed that Cash, as an asset class, performs well in bad market but is actually holding its ground in good markets and should be part of either a defensive strategy or to address surprising / disruptive events.

In 2019:

- JP Morgan AM said: “Cash can offer better risk adjusted than equities and investors and Wealth managers should raise their cash allocations for better diversified portfolios as part of a defensive strategy”.

- Among others, UBS and Credit Suisse high net worth individuals are holding, on average, around 28% of their portfolios in cash.

How should Wealth managers and investors build robustness to negative events and exploit those events?

A. Learn from financial crisis, which has not always been the case. A reminder of the financial crisis since the 80’s: - 1982 LatAm Crisis – 1987 Stock market crash - 1989 junk bond crash – 1994 Mexican Pesos crisis – 1997/8 Asia crisis – 1999/2000 Dotcom bubble – 2007/8 Global financial crisis – 2020 Coronavirus leading to financial crash. *Please note the almost perfect 10 years cycle for financial crisis surrounded by other cyclical events.

B. Ensure diversification in their portfolios with other alternatives than Stock & Bond, through an increase in cash allocation as:

- For aggressive investors, it will allow them for opportunistic acquisitions

- It will allow to reduce volatility in any portfolios

- It will act as a stabiliser for portfolios

- While providing stability it also offers value during crisis

- Bull markets are not perpetual and do have cycles

- Developing and offering more balanced strategies

- Reducing asset correlations

- limiting duration particularly with low yields and anticipation of difficult markets

- Better return for investors

A. Return is achieved through better deposit rates - Diversification risk among banks

- Frictionless and seamless movement of cash

Although, cash has been criticised for reducing portfolio performance, in truth, cash has proven, time and time again that it is a valuable part of any portfolio strategy. It achieves robustness, diversification, and a real alternative to stock and bonds but investors do expect return.

[1] FT 2020,

Akoni helps businesses make the most of their cash. Register free for access to market-leading interest rate accounts, cash planning tools and tips at panel.akonihub.com and follow us on Twitter