UK SMEs have always displayed both desire and overall confidence to trade abroad with both their European neighbours and also internationally. To establish a business with a global reach is central to the vision of many UK business owners when first conceiving of their product or offering and tends to be usually the next step of progression when considering increasing revenue streams.

Yet for years, expansion of SMEs has been held back by lack of financing plans, export readiness and an understanding of the competition faced in target countries.

While there are many external factors that are currently leaving the current economic landscape in uncertainty, two facts still remain certain:

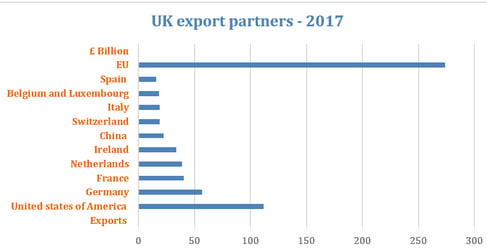

- The EU remains the biggest export region for the UK with £274B exported in 2017, each country in the EU has specific dominant industries for the purpose of trade and can be revised depending on your own corporate requirements

- The biggest single export market for the UK is the US with £112B exported in 2017 (refer to graph below)

- There are various other markets with opportunities across sectors and varying degrees of opportunities and risk factors

Source: House of Commons Library, 11/2018

Source: House of Commons Library, 11/2018

UK Main Export Partners 2017

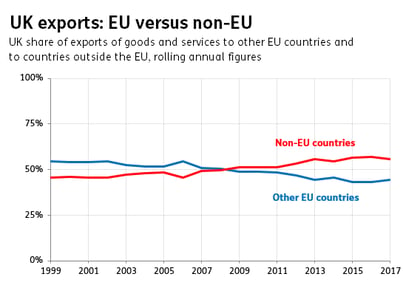

UK exports to the EU have reduced to 45% of the total. In 2017, UK exported £274B to the EU (45% of all UK exports) while exporting £342B to non-EU countries (55% of all UK exports). This is shown below with ‘blue’ representing ‘other-EU countries’ and ‘red’ representing ‘non-EU’ countries.

Source: ONS balance of payments datasets "Exports: European Union" (L7D7) and "Exports: Total Trade in Goods & Services" (KTMW), 11/2018

Source: ONS balance of payments datasets "Exports: European Union" (L7D7) and "Exports: Total Trade in Goods & Services" (KTMW), 11/2018

Opportunities for UK SMEs

There are many benefits to be gained from international trading, with increase revenues and bigger client base being among the top. However, according to a CEBR research, less than a fifth of UK SMEs export. This compares with over 40% of large businesses, leaving a £141B export shortfall in the UK economy.

Surprisingly, only 5% of UK SMEs have plans to start exporting in the next 5 years. It is important to note: UK SMEs who do export generate on average over £287K additional revenue annually from those exports.

UK SMEs that export have benefited with:

- Improved profile and credibility

- Innovation fostering of growth markets and development of the business and relationships

- Exposure to new ideas leading to improved quality of the products or services they are offering

It is an exciting time for business owners and to make the most out of this business owners have to do these key things among others:

- Realising that the “Great Britain" branding has value abroad that can and should be leveraged

- The development of digital tools is helping to reach customers, market info and opportunities quicker, easier and more economically

- The UK Government promotes initiatives to develop and support UK exports and provides a range of support

With this in mind, SMEs now should ask themselves what main hurdles they need to overcome when exporting.

Key obstacles/ barriers UK SMEs need to plan for

With the vote to leave the EU, it is now immensely important for the government to provide support and incentives for SMEs to export their business. As already noted, trade finance is full of opportunities but also carries challenges and risk, among which:

- Identifying markets with the greatest opportunity for your sector and the lowest risk - assessing the various countries and markets, and which are most relevant for your company. This includes many factors including existing relationships, development of new relationships and the type of distribution and reseller arrangements you may prioritise, as well as the ease of doing business including freight, transport and packaging costs, establishment and management of business impacts, as well as the risk of payment.

- Foreign Exchange ("F/X"): the first hurdle once starting to trade

- Weakening of the £ versus € and /or $ will make the export more attractive to the buyers but could impact the UK exporter should it need to import inputs for its products.

- Strengthening of the £ versus € and/or $ will make the exports less attractive to the buyers but could benefit the UK exporter should it need to import components for its products.

- Debtor payments, Credit insurance and Cash management:

- Late payments from UK are difficult to chase and late payments from abroad can be trickier, which requires solid cash management tools to minimise these risks.

- These tools include the initial assessment of the buyer's credit risk, as well as a decision as to whether to purchase credit insurance, which protects the business payment, as well as provides a global support debtors management process.

- Your product's compliance:

- The result of Brexit will be key for the compliance of your product to the EU

- Make sure you understand and comply with the regulations and standards of your export country

With this in mind, there are many potential solutions to address the risks:

- F/X tools such as a forward contract, which will allow you to fix the currency level for a future delivery. You might still get it wrong as you need to take a forward view on the future currency level.

- Multi-currency accounts which, besides being easier, will allow you to match expenses and revenues in the same currency

- Akoni's export planner, including access to various types of credit/ finance. You can find out more by visiting akoni hub directly including extensive guidance relating to the topics and risks noted above.

- Credit Insurance and UK Export finance insurance policies and traditional insurance providers

- Government agencies support

- UKTI’s Passport to Export Service assesses a company’s readiness for international business, and helps it build international trade capability.

At the current level the UK export market still not working towards its fullest potential, but with the pressure of a UK independent from the EU and promises of trade agreements with the Trans Pacific Partnership and other emerging markets, the future seems bright for UK SMEs, as long as business owners make the most of the tools and innovations available to them.

To find out more about check out Akoni's free SME export planner to plan your business foreign trade plan today!